Japanese candlestick charts are arguably the most commonly used charts. It has not always been that way. Candlestick charting techniques were only introduced to western traders in the late 70s by Steve Nison.

A bit of history of Candlestick Charting

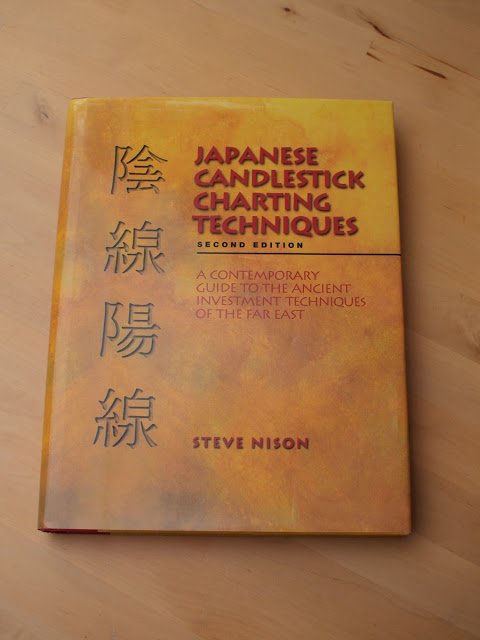

Candlestick charting was invented by a rice merchant named Munehisa Homma in Kyoto, Japan in the late 1700s. The merchant made a fortune trading rice and rice warehouse receipts, the first futures contract ever, using only historical daily price information that he visualized using what we now call Candlestick Charts. The Japanese Candlestick Charts have since then only been used by Japanese traders until the American Steve Nison introduced the techniques to the West in the late 70s. He is still the Western authority on Candlestick Charting. You can find out more about him on www.candlecharts.com. I have one of his books:

|

Japanese Candlestick Charting Techniques by Steve Nison |