|

| United States Mint cutting back on the coin production |

I believe everyone can maintain and build more wealth by holding gold.

In this article, I will try to build my case for this belief. I will cite some bullish news facts for gold. Then I will move on to look at inflation and explain to you why I think inflation is theft and show you that it is robbing you of your wealth. I will conclude with some paragraphs on the Turkish Lira and my personal experience in Turkey that has shaped my way of thinking about money, wealth, and gold in particular.

A bullish case for gold

Below are some of the highlights of what I have been thinking about and watching lately. If you follow me on Twitter, then you might already have seen some of these highlights as tweets or retweets. Not on twitter or being overwhelmed? Just subscribe to this blog by email by clicking the subscribe button at the top of this page and you will receive an email whenever I post new content here.

US Mint cutting back on Gold and Silver coin production

Due to the corona crisis, the US Mint has less capacity to produce coins. At the same time, the demand for normal new coinage has gone up as fewer regular coins are circulating. Also, the demand for investment-grade Gold and Silver coins has gone up as investors are looking for crisis resistant investments. This has led to a higher than normal premium on Gold and Silver coins. Still, Gold and Silver bugs are buying. I guess it is better to buy at a premium then not to be able to buy at all.

Sources: HollandGold, Bloomberg

Russian reserves top 600 billion USD

Russia’s reserve position just topped $600 billion for the first time. Is it because of oil? No. Due to the dollar exchange rate? No. Russian reserves are at record highs because they’re 20% in gold. Nuff’ said. pic.twitter.com/3seZ8D5X1f

— Jim Rickards (@JamesGRickards) August 14, 2020

Warren Buffet sells banks stocks to buy gold mining stocks

These are just some bullish highlights for gold. Now let’s look at my understanding of some of the reasons people are buying it.

Real inflation

|

| Taxation is theft |

Inflation sucks. I personally believe that inflation is theft, just like taxation is theft. A bold statement, I know, but this is how I see it. Now I do not want to get into the taxation discussion. I will leave that for another time, but let’s look at inflation for now. Governments and central banks measure the increase in prices and call this inflation and make policies based on this.

Now, hard money people and Austrian economists mean something different when they are talking about inflation. For them, every increase in the money supply, aka money printing, aka Brrrrr, is inflation in and of itself. For this post, however, let’s define inflation as the increase in the prices of consumer goods.

For years now I have had the impression that the inflation rate that is calculated and shown to the public, does not accurately reflect real/actual inflation as it is being experienced in everyday life. This seems to be the case in every country and for every currency on the planet. It is baked into the cake, I guess.

|

| Inflation sucks |

I know that people in Europe, where I am from, have been complaining that life has become more expensive over the past 20-30 years. I also hear the same from my family and friends in Turkey. And even in the US real inflation seems to be much higher, than officials like to acknowledge, even though the US can basically export their inflation because they have the world reserve currency, the US Dollar.

CPI, Consumer Price Index

What most economists, bankers, investors, and traders look at to gauge the inflation rate is the CPI, or Consumer Price Index. This index is calculated and reported on a monthly basis and is a big driver in the Forex market (and others), because it can, directly and indirectly, guide interest rate decisions of central banks.

If you want to look up the CPI, then here is is the CPI for the Euro Zone:

https://www.investing.com/economic-calendar/cpi-68

Here is the one for the US:

https://www.investing.com/economic-calendar/core-cpi-56

Other countries:

https://www.investing.com/search/?q=cpi&tab=ec_event

Alternatives

Now let’s have a look at something that could show us some more realistic data. For the US / Dollar I could find two sources for this. Unfortunately, I could not find any for the Eurozone or other countries. If you know some sources feel free to mention them in a comment below.

ShadowStats

ShadowStats is a website that offers alternative statistics to many US government statistics. Below is the alternative CPI compared to the official CPI.

As you can see the official numbers systematically seem to underestimate the ‘real’ inflation as measured by the alternative CPI as calculated since 1980. So what is so different? Well, the main difference between the two is, that the official CPI calculation has been and is constantly adjusted, while the ‘alternative’ CPI is always calculated the same way and for the same basket of consumer goods. Some of the adjustments made to the official CPI may be agreeable, but many are pure manipulation in my opinion.

Source: http://www.shadowstats.com/alternate_data/inflation-charts

Chapwood index

Another alternative inflation measuring index is called the Chapwood index.

The Chapwood Index reflects the true cost-of-living increase in America. Updated and released twice a year, it reports the unadjusted actual cost and price fluctuation of the top 500 items on which Americans spend their after-tax dollars in the 50 largest cities in the nation.

This index focusses on the cost of living in the major cities in the US. And what these numbers are telling me is that the 5-year average inflation rate for most cities is around 10%! This is huge. It means in 6 to 7 years the purchasing power of a Dollar in these cities has been cut in half!

Source: https://chapwoodindex.com/

Turkish lira

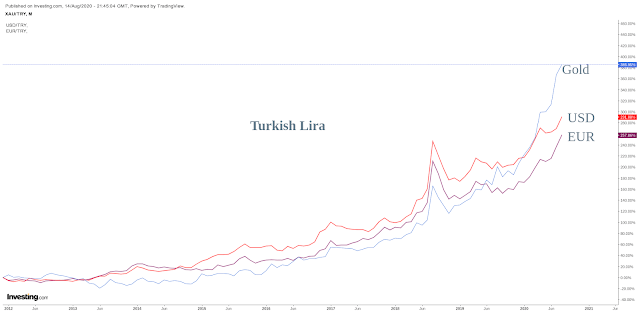

I have a personal interest in following the Turkish Lira, the Turkish economy, and politics. And besides that, Turkey is a fascinating country with a very old heritage and customs particular concerning the use of gold as a store of value and medium of exchange.

I remember that on my wedding in Istanbul, my wife and I received gold as gifts. At that time I thought that was strange. What am I gonna do with gold, I thought. Why not just give Liras, or US dollars, or at that time Deutsch Mark (Yah, that shows my age). Well here is why!

|

| Gold has gone up by 385% to YTL in 10 years |

Gold has gone up by 385% to YTL in 10 years. In other words, if my calculation is correct, the Turkish Lira has lost 80% of its value expressed in gold in 10 years! So people buy and give gold not because they want to make it difficult to spend, but because they want you to be able to buy something a few years from now.

Surviving and thriving in a high inflation environment

I know a goldsmith in Istanbul. I really do, no joke. He is not a trader. He is a craftsman, doing an honorable job, creating gold jewelry. He is a small business owner with a workplace and two or three employees. In the past 20+ years that I have known him, he has done reasonably well for his family and himself. He has never invested in stocks, bonds, or real estate. What he did do, is he always held all of his earnings and savings in gold by default.

So, he did an honest job, kept what he earned, and saved in gold and he did more than fine. This made clear to me, that if you can make sure your wealth is not being stolen, you do not need the insane amount of income growth, you are made to believe you need. You do not need this high paying corporate job or whatever. Just make sure you are not being robbed and you will do just fine.

Debt

Turkish consumers, cooperation, and the government have a lot of debt. Like a lot. Although, we Dutch probably have more personal debt in the form of mortgages. on residential real estate (houses, apartments we live in ourselves).

Consumer debt

I remember that almost all stores would and still offer ‘Taksit’ on every purchase or pay in installments. I always try to get a discount if I pay cash, but I understand that it is more interesting for the shopowner to offer Taksit, due to the benefits the system offers (kickbacks, etc.). Many Turks have gone along with this system and have taken on huge amounts of loans that come due (in part) every month. This has boosted the Turkish economy. My goldsmith friend, however, has never taken any consumer loan.

Corporate debt

Most corporate debt held by Turkish companies is denominated in US dollars. Of course, this is a huge problem and risk. Many companies will get into trouble once they need to pay off the loan or roll it over as revenues are in Turkish Liras and the Turkish Lira is devaluating against the dollar. Just in the past 1 year, the Turkish Lira lost about 26% of its value against the dollar. This is extremely tough, and personally, I would go insane if my company would be in such a situation.

Government debt

In the last two decades, I have seen Turkey change a lot. The government has commissioned and undertaken many large infrastructural and real estate projects. All financed in the US dollar. I have heard stories, that the yearly interest payment on loans for an energy project was larger than the yearly revenue generated by the finished project. This sounds unsustainable to me and will mean energy prices will have to rise. And this is just one of many of such projects. Many of the US dollar loans are about to come due and there are not enough dollars to go around. This is not a specific Turkish problem. Many countries are facing these difficulties.

Solutions

I believe Turkey will overcome all of its problems. The country is resource-rich and strategically located. Also, the population is relatively young. The IMF could provide more loans, but the current administration is not willing to accept these loans as they come with many demands and oversight from the IMF. I personally believe it is better for a country to default on its debt than to give up sovereignty. Also, there are still other options to explore. One of these it to obtain a swap line from the Fed. These are dollar loans issued by the Federal Reserve to other central banks of countries that are in good relation with the US. It is a question of negotiation. And this is where geopolitics comes into play. This could be the reason why Turkey, a NATO partner, decided to buy Russian military equipment. This can now be used as a bargaining chip for getting swap lines.

And as a last resort to get more dollar liquidity, the Central bank could send its gold reserves to London, where it can be used as collateral for US Dollar loans. I don’t think this is an option that should be considered. Basically, you are giving up real assets in order to become more indebted. Also with assets like gold, the saying goes: “You don’t hold it, you don’t own it!” Just think of what happened to the gold of Venezuela.

Conclusion

I have discussed quite a range of topics in this article. Let’s summarize the main take-aways:

- Storing your savings in an asset like gold preserves your wealth

- This way you can become wealthy without the need to be super ambitious career-wise.

- Be in control of your assets: You don’t hold it, you don’t own it

- Don’t let inflation rob you blind.

- Buy a t-shirt or other item with the quotes ‘Inflation sucks‘ and ‘Taxation is theft‘ to wake up the people around you.