|

| Which Forex Pairs are Generally Trending and Which Ones Tend to Revert to the Mean |

In this article, I will systematically investigate the tendency of different Forex pairs to either trend or revert to the mean. I will do so by backtesting a simple trend-following strategy. (Code available on Github. See the end of this article.)

“The trend is your friend.”, is a very well known trading adage. Another thing you read a lot in trading books, blogs, etc. is that the market only trends 20, 30, 40, xx% of the time.

I was wondering how these ideas relate to the Forex markets.

I asked myself the following questions:

- Do all forex pairs have the same trending tendency?

- Are there any pairs that are actually generally more mean-reverting in nature?

- And which Forex Pairs are generally trending and which ones tend to revert to mean?

The reason I was asking myself these questions, is because I have experienced different behaviors between forex pairs while trading the same strategy.

Some pairs just keep going in the direction of my trades, while others seem to turn around more quickly right after I entered in a certain direction.

If there actually is a difference in trendiness between currency pairs, as I expect there is, then this will explain why some trades tend to be shorter-lived at some pairs compared to others.

Hypothesis

In order to answer the questions, I came up with a hypothesis that I could backtest.

If we implement a backtest of a very simple trend-following strategy on a Forex pair based on the daily timeframe over a long period of time and the result is a positive equity-curve, then the pair is generally trending, else it is generally mean-reverting.

Trending in this sense means that if a market breaks out, there is a higher probability that prices will continue moving in the direction of the breakout.

Mean-reverting in this sense means that if a market breaks out, there is a higher probability that the break out will fail and that prices reverse against the direction of the breakout.

Implementation

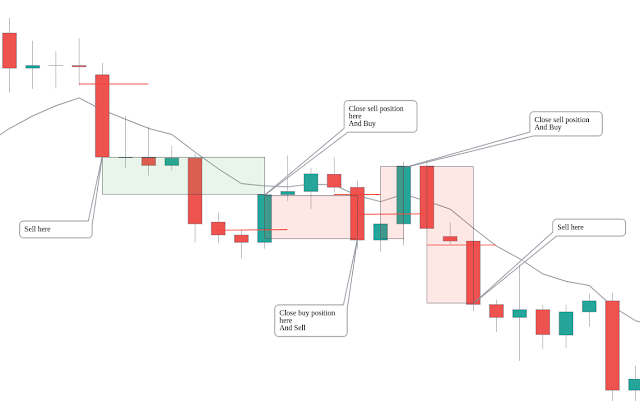

The backtest was implemented according to the following rules.

- We buy/go long once the daily close price has moved above the previous day’s high price.

- We close our buy/long position when the daily close price moves below the previous day’s low price.

- We sell/go short once the daily close price has moved below the previous day’s low price.

- We close our sell/short position when the daily close price moves above the previous day’s high price.

Here is an example of the backtested rules implemented on a chart:

|

| Example of the backtested rules implemented on a chart |

Results

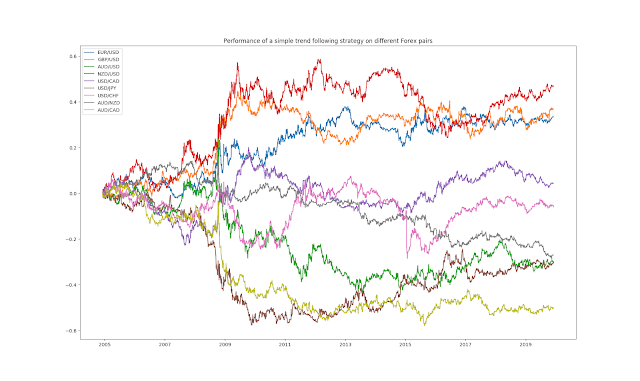

Here is a graph that shows the equity curve for the major pairs plus two extremely mean-reverting pairs over 15 years. As you can see there is quite a difference in performance between these nine pairs. Five out of the seven major pairs are performing at break-even or higher.

|

| Performance of a simple trend-following strategy on different Forex pairs |

Results for the majors

Trending: EURUSD, GBPUSD, NZDUSD, USDJPY (since 2010)

These major pairs seem to be trending in general.

|

| EURUSD |

|

| GBPUSD |

|

| NZDUSD |

|

| USDJPY – Trending since 2010 |

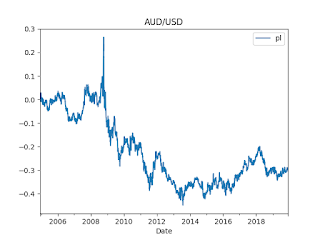

Reverting to the mean: AUDUSD

The Aussie Dollar US Dollar is losing when trading the implemented trend-following strategy. So, in general, there is less follow-through after breakouts on this pair.

|

| AUDUSD |

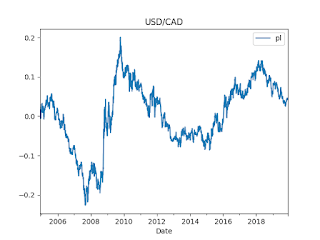

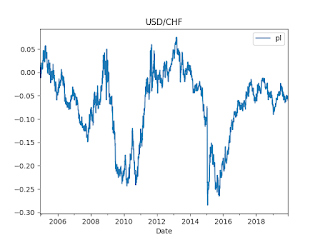

Mixed behavior: USDCAD, USDCHF These pairs have had periods where the trend-following strategy has been working intermitted with periods where the strategy has not been working.

|

| USDCAD |

|

| USDCHF |

Results for the non-majors

Although I have tested all 28 currency pairs that are made up of the 8 major currencies (EUR, USD, GBP, CAD, AUD, NZD, JPY, CHF), I will only post the most extreme cases of trending and mean-reverting pairs here.

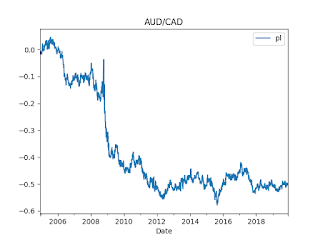

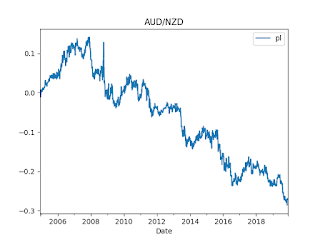

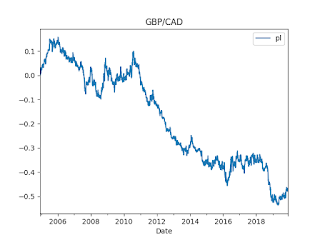

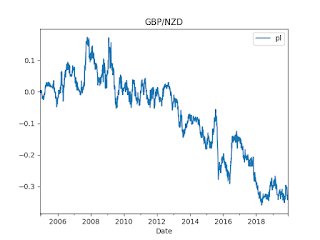

Extremely mean-reverting: AUDCAD, AUDNZD, GBPCAD, GBPNZD

|

| AUDCAD |

|

| AUDNZD |

|

| GBPCAD |

|

| GBPNZD |

Extremely trending: AUDJPY, GBPJPY

|

| AUDJPY |

|

| GBPJPY |

Conclusion

Most of the major pairs are trending markets in general. It should be possible to reach profit-targets at the next support and resistance levels. The AUSUSD has a higher probability to fall short on such targets due to the tendency to mean-revert. This would mean I will want to move my stop more quickly to breakeven than with other major pairs.

Also, it looks like it is worth investigating and backtesting my trading strategy on the AUDJPY and GBPJPY pair.