|

| Finding the right stocks to invest in |

For a long time, I have been hesitant to invest in the stock market myself. The main reason I told myself is that I am already heavily invested in the stock markets via my pension plans.

The thing is I have no control over my pension plans. I just have to hope the money I put in is managed well and then hopefully when I am 70 years old I might retire.

Wait a minute … 70!? Yes, 70, or maybe even later. Governments keep changing the rules concerning retirements.

That is why I have decided to build up a stock portfolio outside of the tax benefited pension plans. I want to build a portfolio of shares in good companies that will pay me dividends. This portfolio should, once it has grown enough, generate an income through dividends alone that will cover most of my expenses.

To achieve this we need to buy dividend-paying stocks at cheap prices. In this post, I will tell/show you how I go about this.

Dividend-paying stocks at a good price

In the below video, I show you how you can find dividend-paying stocks at a good price.

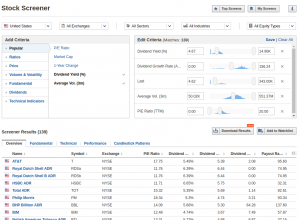

In the video, I use the stock screening tool by Investing.com.

If you follow the link you will find in the top right the Top Screens button.

Click this button and then select: “Dividend Payers Whos Stocks Are Cheap”. This should give you the first selection of stocks and will look like this.

Let’s run through the selection criteria real quickly.

- Dividend yield (%)

The dividend yield in percentage is the yearly dividend payout divided by the share price. This percentage tells you how big a return you will get on the money you put in the stock if you buy it right now and the dividend remains unchanged over time. I like to see the yield be at least 2%. You can play with the value in this filter and see what the results will be. - Dividend growth rate (ANN)

The dividend growth rate tells us how much the dividend has been increasing or decreasing. We want to see a positive growth rate. In general, if companies start paying dividends, then it is seen as a sign of weakness once a company decreases its dividends. - Last price

This is the current share price. Everything below 5 USD is considered a penny stock. Penny stocks are very volatile and mostly very illiquid. We, therefore, exclude them. - Average volume (3)

This shows us how many shares have been trading on average during the past 3 months. We want to see high enough volume, so we can be sure that there is enough interest in the stock and that there is proper price discovery. - P/E Ratio

This is the Price to Earnings Ratio. This ratio is generated by dividing the share price by the earnings per share. This tells us how much we are paying for the earnings potential of the company. In other words, it tells us if the shares are cheap or not. A P/E ratio of lower than 20 is considered cheap.

Volatility

In the video, I added two more filters to narrow down the list of stocks. I wanted to filter out the low volatility stocks. These kinds of stocks usually perform better while at the same time make it easier to hold on to them as the price swings are less.

I used the Beta for filtering. Beta tells us how much the stock price movements are correlated to the price movements of the S&P500 index. A Beta of 1 is perfectly correlated. A value of 2 means that the stock moves twice what the S&P movement has been. Therefore a Beta value of 0.1 to 1 is considered comparatively non-volatile.

Dividend safety

Not only do I want to avoid a bumpy ride, but I also would like to be sure that the company can continue to pay dividends. I want to understand if the dividends they are paying are safe. This concept of dividend safety can be inferred by looking at the payout ratio.

The Payout Ratio is the percentage of the total earnings that are being used to pay out the dividends.

If the payout ratio is 50%, then this means that half of the total earnings are being paid out to the shareholders as a dividend.

The ratio that is seen as safe depends on the sector and type of business.

Real estate stocks (REITs) are obliged by law to payout at least 90% of their earnings as dividends.

Utility companies operate on low margins and usually finance their operations with long-term loans. Therefore they can usually pay out a high percentage of their earnings.

Most other companies should have a payout ratio of less than 60% to be considered safe when it comes to be able to continue to pay out the dividends that they are paying out right now.