I own crypto currencies, because I have come to the conclusion that money as we know it today is no longer sustainable. I have come to this conclusion during the crisis of 2008. At that time I had the intuition / the gut feeling something was wrong not only with our financial system, but more specifically with our money. It took a few years of researching and investigating until I figured it out. The thing is, part of me did not want to believe it was true. And for a long time I did not act upon the intuition and knowledge I had. That changed last year when I decided to put my money where my mouth is and I started to accumulate crypto currencies. Cryptos align perfectly with my expertises: coding and trading. So I went for it… And with success.

Now I want to diversify my holdings more by adding Gold and Silver to it. I buy Gold and Silver as a hedge or insurance against the undwindled money printing of all of the governments / central banks of the world. Money, or actually, currencies are continuously losing value. That is one of the main reasons I trade / take a trading approach to investing. Large returns on equity are needed just to keep up with the race to the bottom that all major currencies seem to be on.

So I took a closer look at Gold and Silver. I will share my findings here with you, but basically I have come to the following conclusion:

Gold and Silver are relatively cheap!

Silver is even more cheap than Gold.

More later on how I have come to this conclusion. First, read on and follow me on my thought journey that made me look (again) at Gold and Silver in the first place.

Book

The core of my ideas about Gold and Silver are from the book: Guide to investing in Gold & Silver by Mike Maloney. Mike Maloney has a website www.goldsilver.com. I once signed up for his news letter and then received his book in PDF format for free. I am not sure if this offer is still available, but you can always buy his book online. It is a concise and interesting read. Mike makes a case of how Gold and Silver have played the role of real money for more then 5000 years and that fiat money / currencies have a proven 100% fail rate.

Difference between money and currency.

One of the main things you need to understand, is that our fiat money is currency and that it is not money. Most people call Euros, Dollars, etc. money, while actually it is not money. Not understanding this is a big problem. Below is the first video in a series of videos called: “The hidden secrets of money”. It does an excellent job explaining the difference between money and currency.

In the video it is explained that money has the following properties:

- it is portable

- it is durable

- it is divisible

- it is fungible (interchangeable)

- it is a store of value

Gold and Silver have all of these five properties. Our current “money” has only four. Do you already see which one is missing? Watch the video and you’ll find out.

History repeating itself

Another one of the main points that Mike Maloney and many others like Max Keiser and James Turk, just to name a few, keep making, is that what is happening right now has happened many times before.

Some examples:

– Financial crisis in the Roman Empire 33AD

– Fiat money inflation in France : the Mississippi bubble (1718 – 1720) and the Assignat (1789 – 1796); see below two videos.

– Hyperinflation in the Weimar Republic 1918 – 1929

– more examples

And now we are doing the exact same thing all over again. Things may be called differently and maybe the powers that be really believe that this time it will be different. But I am not willing to bet the house on that. How about you?

Quantitative easing

Quantitative easing or QE for short is just a complicated term for more fiat money printing! Below are two videos that tell the story of fiat money printing in France in the 17th century that ultimately led to the France Revolution in 1789. They say the guillotine was invented for bankers?!

What to do, what to do

Seeing all this, knowing all this, feeling all this, I wonder what to do. Surely, I do not have all the answers, but I will not just sit on my hands and do nothing. Buying and holding Cryptos, Gold and Silver allow me to own assets that I have maximum control over. Of course, governments can try to confiscate these assets or can try to make it difficult to exchange and spend them, but they will have to fight me for it, while paper assets like stocks, bonds and savings accounts can be confiscated without me being able to do anything about it. And if governments will not confiscate paper assets, they can and will manipulate them.

Precious metals are still undervalued

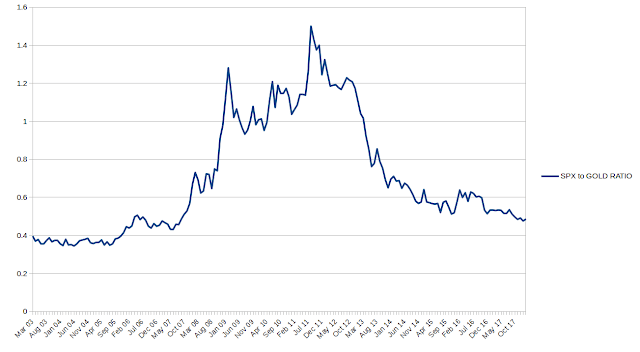

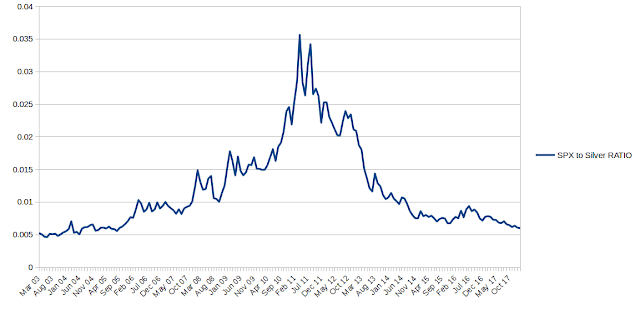

I have analysed how the valuation of Gold and Silver has been for over (at least) the past 15 years and I have come to the conclusion that both Gold and Silver are valued very low at the moment. But especially Silver is undervalued. My ultimate goal in my (financial) live is not to have a lot of “money”, but rather my goal is to have assets like houses and land and to own stuff like cars, computers, boats etc. Hell, maybe I even do want that Ferrari I hinted on in my previous post :-). So when determining the value of Gold and Silver I looked at how much assets / stuff I would have to give in exchange for Gold and / or Silver. As a proxy for this I used the S&P500 index, as this reflect the valuation of the 500 largest companies that produce and offer these assets and things.

Fig. 1 and 2 show that the valuation of both Gold and Silver peaked in 2011 as prices had been rallying after the banking and housing crisis in 2007 and 2008. Currently the valuations are again at pre-crisis levels. Therefore I feel confident to start buying Gold and Silver instead of putting new money into the stock market. So now the question is:

What do I buy first? Gold or Silver?

Below is fig. 3 and it show the ratio of Silver to Gold. Around 50 seems to be the mean in the ratios. Around the 30 to 40 level Gold is undervalued to Silver and at 80, the current level, Gold is overvalued to Silver.

Data source: investing.com

Therefore I say:

It is time to start stacking Silver first

How to start stacking Gold and Silver

I already have some Gold and Silver. Besides some jewelry I have 1 Silver ‘junk’ coin, known as the ‘Zilveren Tientje’ (https://nl.wikipedia.org/wiki/Zilveren_tientje). It’s not pure silver, but 72% silver only. It was a gift from my grandmother and I will therefor rather not sell it. Then I have some thin gold coins that my wife and I got from friends and family at our wedding in Istanbul. I did not fully appreciated at that time what they have given us. I mean, it is not a fortune, but after all these years it has kept it’s value. So when you start, I suggest you check to see if you haven’t already got some Gold and Silver.

I only want to be holding physical Gold and Silver. To do this, I will buy Gold and Silver coins, otherwise known as ‘bullion’. There are many online bullion sellers. Just do a search online for “buy Gold Silver” and you will find many shops. I can’t yet make any comments on any of the shops, because I haven’t bought any coins yet. However I did do a lot of research and I have learned the following:

- bullion trades at a premium over spot price

- the higher the quality / beauty of the minting / coin, the higher the premium

- there are government minted and non-government minted coins

- government minted coins will usually be easier accepted

- coins come in many weight from 1/20 oz to even 10 oz

- there are also bars, that are weighted in grams. They are available from 1 gr up to 1 or more kilograms.

I will be looking to buy silver coins with the following properties:

- minted by government

- 1 oz weight

- only 0.999% or more pure silver

- lowest premium possible

I am not looking for collectors items, but for coins, that when the time comes I can easily exchange for assets, goods, services, cryptos, or maybe even currencies. The following coins are on my shopping list:

- Australian Silver Kangaroo

- Canadian Silver Maple Leaf

- American Silver Eagle

- Austrian Silver Vienna Philharmonic

- Brittania

The Maple Leaf and the Philharmonic seem to have the lowest premiums looking at prices offered by Dutch bullion sellers. This can probably change over time and can be different in your location, I am sure.

Keep hodling! Keep stacking!