I have been researching strategies to invest money for my retirement in a smart way, that does not take a lot of time and does not keep me up at night. After many, maybe hundreds of hours I finally came up with a very simple strategy. In this video I show you what my back tests are showing. I am working on an e-book in which I will explain in detail how the strategy can work for you and how I use it to build up wealth of my own. Let me know in a comment if you are interested in the e-book. It will motivate me to get it out sooner rather than later.

Why invest

This is an important question. Investing will take consistent effort and risk taking, so you better have a very good reason for doing it. Sure, you can let someone else manage your money and be done with it. But then consider why they are doing this. What thrives them is something entirely different from what thrives you. Money managers want to keep your money invested at all times, as they get paid fees on money invested, but this is not necessarily what is best for you. By now you must have figured this out already, else you would not be reading this.

So before you read on, I encourage you to write down why you want to invest yourself. And do not say you want to gather more money. Money is just a by-product. What do you want to achieve? What would you do if money was no object? For me the main reason to invest is freedom. I want to be able to do what I want , when I want it. Now, what thrives you? Think about it, discuss it with your partner, close friends and family. And write it down.

Once you have this written out, add clear, specific and obtainable goals, like: “My account will reach 40,000 USD by December 2022.”. Now read this every time before you look into your investments. This will help you stay focused even when your investments are (temporarily) performing less then you hoped for.

How to invest

So now you have a clear picture of why you want to invest yourself, let’s investigate how to go about it. I will first describe common ways / techniques of investing, that are used by professional entities like pension funds or mutual funds. I will then explain why these, although valid ways of investing, are sub-optimal as they do not control risk the same way you could control risk when investing by yourself.

Buy and hold

This is the way of investing most people think of when talking about investing. You just buy a security and hold it, hoping it will appreciate over time. If you bought the right stocks you will do more then fine, but the trick is to pick the right stocks. As this is very difficult, the solution is to diversify your portfolio to average out the losers with the winners. This is usually the advise you will get from a financial planner. It can work reasonably well if you still have 30 years or more to hold the investments.

Averaging in

Another investing technique that most pension plans rely on and investment funds use is averaging in. Averaging in is a technique were you periodically buy into a security for the same money amount. So for instance, you will buy a 100 USD amount of shares in stock ABC every month. The idea is that while the stock price is falling you will buy ever larger quantities of the stock. And as the price rises the ever larger quantities you bought when the price went down, will contribute ever more to your portfolio value. The main assumption here is that in the long run the stock price will move higher and will never drop to zero.

Life cycle investing

Most pension plan implement some sort of life cycle investing. And also many money managers tell you this is the wise thing to do. Life cycle investing, basically means that you scale down the risk in your portfolio the closer you get to your retirement / the moment you will need the money to life of. This means that your portfolio will contain mostly stocks in the beginning of the cycle and will contain ever more bonds and money market securities (equivalents to cash) as you approach the end of the cycle (see illustration 1: Life cycle investing).

Sub-optimal strategies

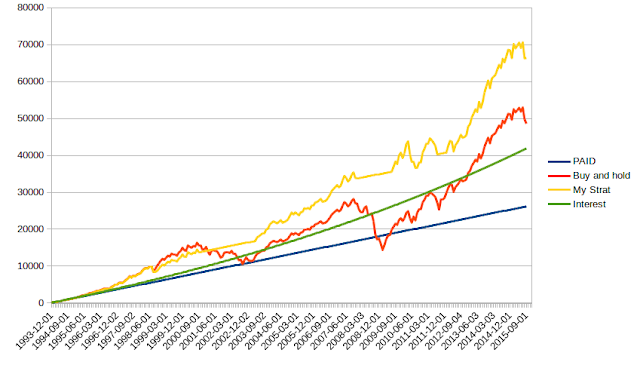

My research shows that above mentioned strategies are OK, but that these strategies are actually sub-optimal strategies. The reason large mutual funds and pension funds implement and advise buy and hold strategies is that this is all they can offer. When markets go down it makes sense to stay out and keep your money in cash. Large investment funds however cannot stay out of the markets as they simply have to much money to invest. If they would pull out all of their money under management all hell would break lose. Most funds advise their clients to keep calm as markets go down. Everything will be alright over time and usually it will, but you will have wasted time as your portfolio finally gets back to the same value it had 10 years before. Just have a look at illustration 2: Buy and hold investing. If you invested in the S&P500 as of 1993, then your portfolio value peaked at 1999. It then took until 2011 before your portfolio value was finally higher then the previous high at 1993. You just wasted 12 year to just break even while paying a on average 2% maintenance fee to your money manager / pension fund.

The picture becomes somewhat better if you average in over time.

But with a little bit of effort (about 20 min per month) it is possible to optimize your investment by avoiding big down turns while still being able to take advantage of the up side opportunities in the markets.

Learn this strategy

I will explain this strategy in this e-book. It is intended for anyone looking for a way to build up a nest tag or retirement fund by just spending 20 minutes a month or less managing investments and without having to worry about the ups and downs of the markets. So you might have a 401K, IRA, ROTH, or an after tax brokerage account and the desire to invest without laying awake at night, then I wrote this e-book to let you build the confidence to invest all by yourself. The first thing you will earn, are the management fees you save by investing yourself.

Download will include a zip file with an ebook and spreadsheets.